7 Feb 2019.

Most mergers and acquisitions fail.

Consultancies and financiers will disagree over the percentages, but they are unified in their agreement that the vast majority of M&A deals fail to deliver the outcomes they set out to achieve – let alone the expected Return on Investment.

Download the pdf version here.

Many corporate advisers are also unified in their utter indifference. The Head of M&A for one of the largest global consultancies admitted this to me in a particularly candid moment:

“We make so much money on the transaction. While we have a business transformation unit in the group, most of the time we simply move on to the next deal.”

The primary focus of many advisers seems to be creating value for themselves – seeking to finance new deals, provide legal services for new deals, conduct due diligence for new deals or simply trading the debt of distressed companies. They are not genuinely interested in the success of the underlying companies.

Too many don’t actually care whether the merger succeeds or not; whether the acquisition increases long-term shareholder value or destroys it.

This is wrong.

Successful mergers and acquisitions create genuine shareholder value, generate productive jobs and boost the wider economy.

But success is elusive. The two obvious questions are:

- ‘Why do most fail?’ and

- ‘What can we do to give our next merger or acquisition the best chances of success?’

Let’s answer both of these questions simultaneously.

Part 1: Pre-deal – setting up the merger to succeed

- Honesty about why we are doing this.

Why, why, why. Understanding the motivation for the deal is the crucial first step. There is a right reason and a real reason for everything. Be honest to yourself about both of them. The right reason for the acquisition may be to expand into Europe. Why is this a good idea? How will this acquisition benefit our customers? The real reason may be to enhance the CEO’s CV. If the real reason isn’t right – don’t do it.

- Clarity of what success look looks like

Once we are genuinely clear about the driving reasons behind the acquisition, we must define success – both the numbers and the narrative. What are the numerical thresholds above which we can declare success? Also, what are the qualitative measures below the headlines that are just as important – what sort of business will we be after the transformation? What positive changes will our customers, employees, partners, suppliers and shareholders experience?

- Genuinely objective due diligence

The due diligence needs to be as objective as possible; untainted by the hopes and optimism of the acquiring leadership. Use external professionals and permit them to remain independent as they can help you avoid Groupthink. Don’t hire them to agree with you. Hire them to challenge you. Not proceeding with the wrong deal will be one of the best decisions you will ever make.

Extend that due diligence to your own organisation. Do you have the capabilities you need to make a success of this acquisition? Do you have the management bandwidth to pull this off?

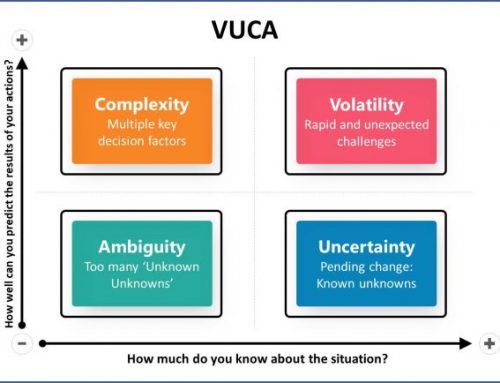

- Understand the implications of the deal

Too many mergers and acquisitions fail because they simply bite off more than they can chew. Understanding the key implications of acquiring the business is critical. Are the two cultures compatible? Are the systems compatible and how big are the required changes? How will employees react? Providers? The media? Competitors? Ask yourself ‘What could possibly go wrong?’ across a number of different areas of the deal. And answer yourself truthfully.

- Understand the magic you must retain.

What is ‘magical’ about your organisation? What is ‘magical’ about the target business? What of their ‘magic’ should you retain? What do they do better than you? There is no room for arrogance or complacency. Clearly identify the real value of the business you are acquiring – their people, their customers, their distribution relationships, their systems, … identifying the ‘magic’ you have bought is the first step to retaining it.

- Don’t over pay – too much.

You will overpay. Just try to not overpay too much. Several trillions of dollars are waiting impatiently in corporate balance sheets and PE funds, desperate to be invested. Private Equity is the hottest asset class among institutional investors across the world. The competition is fierce and the market is scorching. The odds of ‘overpaying’ are high.

Which of course makes the delivery phase even more critical.

Part 2: Delivering the future

- Ensure the customer experience is seamless throughout the transition

Customers of both organisations will be wary. This is the time that the opposition will swoop to prey upon any uncertainties – real or perceived. A massive and genuine customer engagement exercise is essential. You must also do your utmost to ensure that the organisational changes do not adversely affect the customer experience. Or they will leave.

- Define the culture you need to succeed and work incessantly to build it

Success demands a culture that is actively aligned to delivering the strategy. And an organisation gets the culture its leaders create. What elements of your culture need to change? What elements of the target’s culture needs to change? Cultures need to be defined before they can be delivered and then behaviours clarified, starting with your new leadership team. Ask your people (and customers) to tell you the reality of what your culture is today. Then work tirelessly to bridge the gap.

- Alignment of incentives

Incentives drive behaviours; behaviours drive results.

“Aligning incentives” was regarded to be the most important ingredient to M&A success by the audience of a Leading Change workshop I ran at the M&A Advisor Distressed Investment Summit in Palm Beach last year.

Are the incentives of the newly acquired executives the same as the incentives of the acquiring executives? Are any exceptions to this rule ‘fair’? Are all incentives aligned to delivery of the outcomes defined earlier? Are they aligned to shareholder expectations? Do the incentives at all levels create the behaviours you need for long-term success while also encouraging the post-deal short-term outcomes?

- Swiftly engage your new full team

This is a new dawn – for everyone. Revisit the post-merger strategy and implications – with your entire new team. Get everyone engaged in mitigating the obstacles to success and looking for new opportunities.

- Genuine communications and emotional engagement

Change initiatives that fail to communicate, fail. And the most important weapon in a change leader’s armoury is listening. Everyone in the new combined organisation needs to be listened to. They need to know that their fears, concerns, hopes and ideas have been heard and taken into consideration. As a leader of change, you will need to appeal to your people’s emotions, for emotion is four times more powerful than logic. People won’t change because you tell them to. They will only genuinely change if and when they want to. You must help them to want to change.

- Don’t delay implementation

When it comes to change, you either pay now or pay later and if you pay later – the costs will be much higher. Waiting for organisational change initiatives to start can be stultifying. Everyone knows change is looming. Get on with it.

- Set the change programme up to succeed

This is a change programme. Treat it like one. But make sure your steering group is small and that responsibilities are clear. Make sure your decision-making processes are also clear and accountability is obvious to all. The same for your working group – make sure it is small enough to be effective, large enough to deliver and that its mandate and responsibilities are clear.

- Pause for reflection

Build in pauses for reflection. Stages in the change process where everyone pauses and asks: Is the end goal still achievable? Are the outcomes still desirable? What new facts have emerged that bring new light to our plans? Facts change. Circumstances change. Changing direction is OK. Blundering on regardless of new facts and experience is not.

- Support the Remainers and look after the Leavers

Almost every merger or acquisition will result in people leaving the company. If done correctly, this can be a net positive experience for almost everyone involved.

- First: Train your people to embrace change. People can feel powerless when big change is done to them. They aren’t powerless – the one thing they can control is how they react. They can fall in a heap or they can accept the change and start to look for opportunities. The same goes for the survivors. They will also need to be ready and willing to change.

- Second: To avoid ‘survivor syndrome’, you must treat those leaving extremely well. Help them to leave with self-esteem and a sense of optimism about the future. Thank them genuinely and publicly, pay them well as they leave and do whatever you can to help them make their next move. The Remainers will be watching very closely.

- Don’t get distracted

Never take your eyes off the outcomes you set out to achieve. Keep your attention on delivering success – or the acquisition will fail. The forces against successful change are simply too great.

The leadership must be the catalyst for successful, sustainable change.

Download the pdf version here.

Campbell Macpherson, CEO of Change & Strategy International, business advisor, keynote speaker and author of ‘The Change Catalyst’, 2018 Business Book of the Year.

e: campbell@changeandstrategy.com